Are debts shared in divorce? Great question. We held our first-ever webinar a couple of weeks ago to answer questions on divorce and financial settlements.

The vast majority of questions centred around financial settlements. In case you don’t know, in the UK, financial arrangements are not dealt with by the divorce but by something called a consent order.

What is a consent order?

A consent order is an instruction from the court that describes how the finances of divorcing couple will be split (or not in terms of a clean break order).

The consent order can cover all kinds of things like selling your house and splitting the proceeds, splitting a pension and paying lump sums. Anyway, some of the questions that came up on the webinar asked about debt.

These are questions close to my heart because when I went through my own divorce, I had an awareness about splitting assets, but the solicitor I used did not tell me that debt could be split too, which ended up costing me a lot of money.

Backstory – I started Easy Online Divorce because of the pain of my own divorce and the lack of good information provided by the industry that caused me to make poor decisions.

Are debts included in a financial divorce settlement?

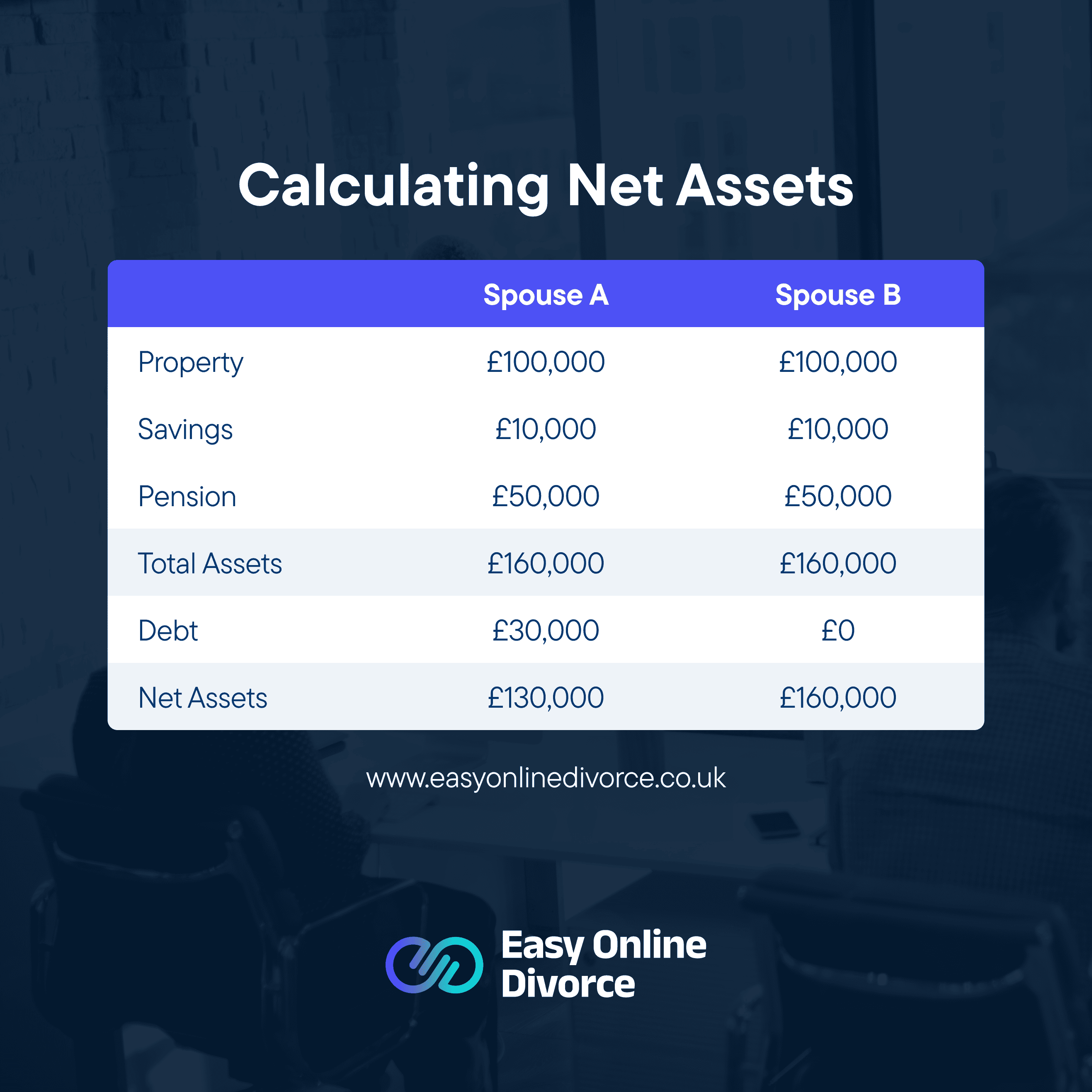

When deciding how to split assets, you and your husband or wife have to list the total value of assets that you have in property, savings, investments, and pensions. In addition, you list the liabilities that you have.

When deciding on a fair split, you should consider the total net value of your assets. (Net value means what you have left after you have taken away any liabilities from your assets) – see the example below.

Calculating net assets for a financial divorce settlement

Can I share debt in my divorce settlement?

So, one of the questions we had was, ‘Can I share the debt with an ex that was taken on through the marriage?’ Another was ‘I have £20,000 in credit card debt that was used for household expenses. Can this be shared in a settlement?

The answer to both of these questions is an absolute yes.

Using our example, if you worked out your split based on assets alone, it wouldn’t be fair. However, in a real-life example, the split doesn’t have to be or even should be 50/50. For example, you might decide to take on all or a greater share of debt if your ex is on a lower monthly income, making it hard or even impossible to pay back their share of the debt.

For more information about consent orders visit our page here, call 0204 530 8101 or book a free consultation with one of our friendly advisers.