How to work out child support payments

One of the first things divorcing couples with children want to know is how much their child support payments will be. This is understandable, the primary concern of the resident parent, that is the parent who the children live with most of the time, is will they be able to afford to look after their children. Whereas the non-resident parent is usually concerned about how they will manage their finances overall because they are now likely to incur additional property costs.

The purpose of child maintenance is to provide support for a child’s everyday living costs. The non-resident parent must make payments to the resident parent, who is responsible for the child’s day-to-day care.

Three methods to determine child support payments

There are three ways to determine how much child support payments will be:

- Decide informally with your ex-partner.

- Hire solicitors to help you reach an agreement.

- Have the Child Maintenance Service (CMS) calculate the amount.

Working out child support payments with your ex-partner is a practical method; consider using a mediation service if you are having difficulty communicating. However, this informal approach carries a level of uncertainty, as either party can revisit the amount at any time in the future.

Agreeing on child support payments using the help of solicitors will be costly but may be necessary if your finances are complicated. You can also ask the court to make the child maintenance payments legally binding. This approach might be useful if you anticipate becoming increasingly wealthy. The downside is that if your circumstances take a turn for the worst, you would still be legally required to pay the agreed amount.

The Child Maintenance Service

The CMS has come under fire in some circles, but in my experience, they are relatively straightforward, and their calculations are transparent and fair.

Along with limited access to children, child support payments create the most frustration amongst fathers. Some argue that they are happy to pay for their children, but they want all of the money spent directly on their children.

In these circumstances, it is helpful to consider that your separation should not result in suffering for your children and their mother. When you were all together, you enjoyed a certain kind of lifestyle, which should continue where possible.

If you still earn the same amount of money as you did when your family was together, the CMS will calculate an amount that should maintain the lifestyle enjoyed by your children. This includes the type of home your children live in and the type of activities that they can enjoy.

How the CMS Calculates Child Support Payments

The Child Maintenance Service follows six steps to calculate the amount of child support you will pay. The amount is reviewed every year and can change based on changes in income or family circumstances. For clarity, the example is written based on the non-resident partner going through the process.

Time needed: 45 minutes.

How the CMS Calculates Child Support Payments

- Calculate your annual gross income

The CMS works out child support payments using your taxable annual gross income as the starting point. Income includes earnings from employment, self-employment (profits from a business), occupational or personal pensions and certain benefits. Annual gross income is your yearly income before income tax, and National Insurance have is taken, but after your employer or personal pension scheme deductions.

The CMS usually takes these figures from HM Revenue & Customs (HMRC). HMRC uses the information from your last complete tax year, which runs from 6th April in one year to 5th April in the next.

Your circumstances may have changed in your current tax year. Perhaps, for example, you received a bonus in the taxable year that you do not expect to receive this year. Unfortunately, the CMS will still calculate your annual gross income at this higher level, unless the previous income level is 25% higher than that from the current year. - Take away personal pension and special expenses from your weekly gross income

Your gross income in Step 1 can be adjusted if:

• You make payments into a personal pension scheme.

• You have certain costs or expenses.

Contributions into an employer pension scheme are accounted for in Step 1, but if you pay into a private pension, you should deduct it here. For example, if you have a gross income of £27,000 a year and make annual private pension contributions of £1000, the amount of gross income the CMS will consider is £26,000.

You can ask the CMS to consider certain costs or expenses that can reduce the gross income figure used to calculate child support payments. You can apply for a special expenses variation for the following:

• Travel costs to maintain regular contact with your child (if more than £10 a week)

• Costs connected with supporting a child with a disability or a long-term illness

• Repaying debts from your former relationship, for example, a car loan for a car the receiving parent has kept

• Boarding school fees for children who qualify for child maintenance

• Paying the mortgage for the property where the receiving parent and child live

After taking personal pension contributions and variations into account, the CMS converts considered gross income into a weekly gross income. This is done by dividing gross income by 365 days and multiplying that number by 7.

A gross income of £26,000 would be equal to a weekly gross income of £498.63.

This weekly figure allows the CMS to make additional reductions based on any other children you support. If you have other children, the CMS will reduce your weekly gross income by the following percentage:

11% reduction for one child

14% reduction for two children

16% reduction for three or more children

For example, if you support one other child, your weekly gross income would be reduced by 11%, leaving a considered weekly income of £443.78. - Determine your child maintenance rate

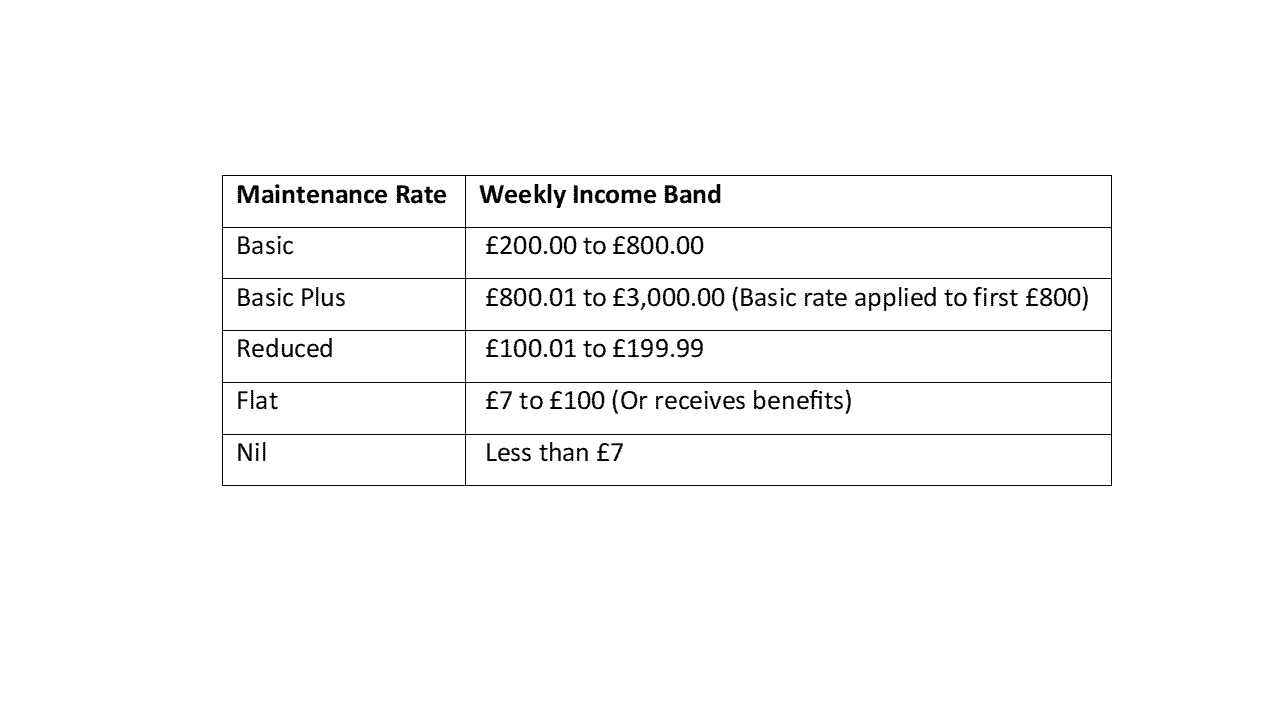

Child maintenance rates are assigned based on your gross weekly income.

In our example, £443.78 would fall under the Basic child maintenance rate. - Assign the number of children to receive child support

The CMS applies the number of children included in the application for child support.

- Calculate the weekly child support payment

Basic Rate

The Basic rate applies if your gross weekly income after Step 2 is £200 to £800. The CMS base the amount of child support you will pay each week on the following percentages:

12% for one child

16% for two children

19% for three or more children

For example, if you have two children and a gross weekly income of £443.78 at Step 2, you would pay 16% of your gross weekly income or £71 per week.

Basic Plus Rate

If your gross weekly income after Step 2 is more than £800 up to a limit of £3,000, the Basic Plus rate of child maintenance is applied as well as the Basic rate. In addition to the percentage rates applied to the first £800, the following percentages are calculated on any balance over £800:

9% for one child

12% for two children

15% for three or more children

For example, if you had two children and a gross weekly income of £1000, you would pay £152.00 per week.

Reduced Rate

If your gross weekly income after Step 2 is more than £100 but less than £200, you will pay a fixed rate of £7 a week for the first £100 and the following percentage will be applied to the balance:

17% for one child

25% for two children

31% for three or more children

For example, if you had two children and a gross weekly income of £150 at Step 2, you would pay £19.50.

Flat Rate and Nil Rate

If your weekly gross income is less than £100 or you or your partner receive certain benefits, you would pay a flat rate of £7 a week in child maintenance.

If you are under 16, a student aged 19 or less, in prison or a care home, you would not have to pay any child maintenance. - Work out shared care

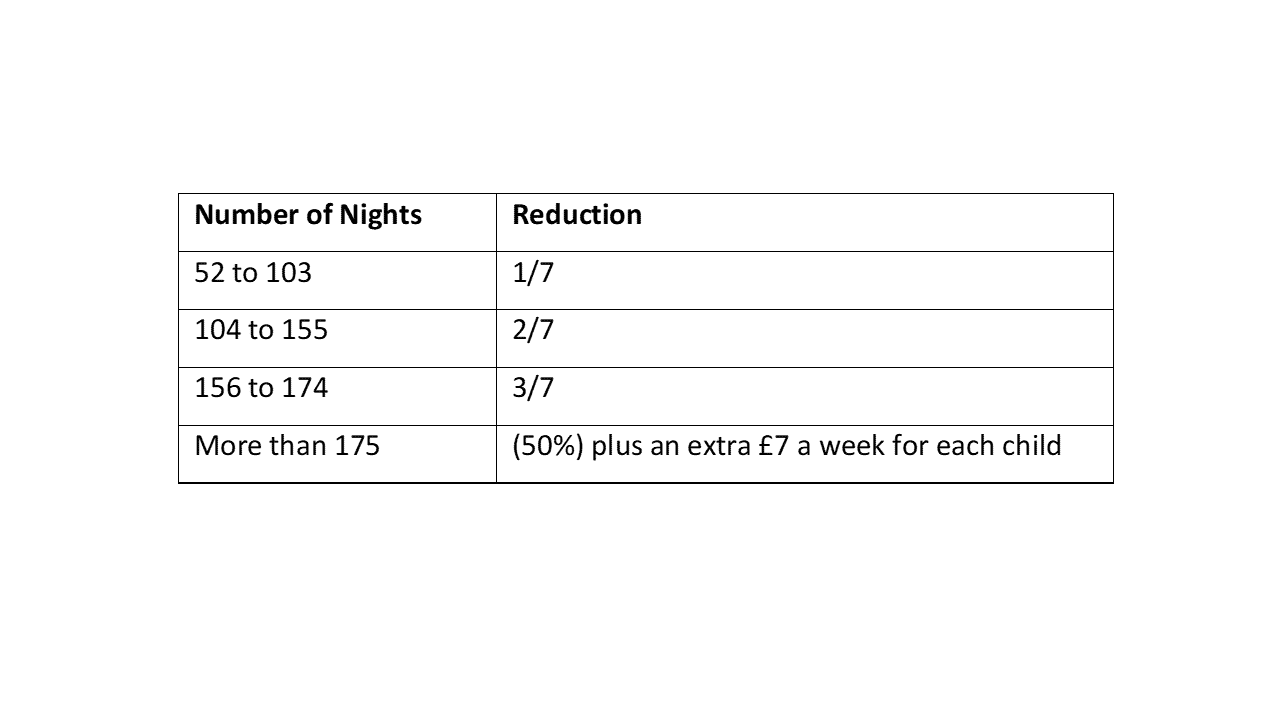

If your child stays overnight with you at least one night per week on average, you will receive a reduction in the amount of child maintenance you pay. The more nights that your children stay overnight with you, the more the CMS will reduce the weekly amount of child maintenance.

For example, if your children stay with you on Friday and Saturday night each fortnight, this would add up to 52 nights per year. This would reduce the weekly child support payment by one-seventh.

Paying Child Support

Once your child support payments have been calculated, you will receive a letter that provides a breakdown of the information used to reach this amount. You can choose to use the Direct Pay method to deposit the correct amount into your ex-partner’s account each month.

The alternative is the Collect and Pay service, which you should avoid at all costs. Here, the CMS collects the amount from your bank account or directly from your employer. Not only is this potentially embarrassing, but the fees are also punitive.

The paying parent is charged a 20% fee on the child maintenance payment, and the receiving parent has 4% subtracted from the payment.

You will pay child maintenance until your child is at least 16 years old unless they decide to continue with full-time education. This includes A levels but does not include university or professional studies. The payments will end when the course finishes or when the child turns 20 years old, whichever is sooner.

Parentage

The Child Maintenance Service (CMS) assumes that you are the parent if you:

- Were married to the child’s mother at any time between the conception and birth of the child (unless the child was adopted)

- Are named on the child’s birth certificate (unless the child was adopted)

- Have taken a DNA test that shows you are the parent

- Legally adopted the child

- Were named in a court order as the parent when the child was born to a surrogate mother

If parentage is assumed, the CMS will work out the amount of child support payment. You will have to pay this amount unless you can prove that you are not the parent.

What if you’re not the parent?

If you deny that you are the parent of a child, the CMS will ask for evidence, and they may ask you to take a DNA test. You will have to continue paying the calculated child maintenance amount until you can prove that you are not the father. The CMS may refund any payments made after the date that you first denied being the parent if you can confirm your claim.

If the amount of child maintenance has yet to be calculated, then you will not have to make any payments until the disagreement has been resolved. However, if found to be the parent, the amount of child support to pay will be backdated.

Penalties for non-payment of child support

Penalties for not paying child support are severe. The Child Maintenance Service can take the one-off or regular payments directly from your salary, bank or building society without your permission. The CMS can also take court action, which can result in bailiffs being instructed to remove and sell your belongings. You can be put in prison for up to six weeks and forced to sell your house to pay for the child maintenance owed.

The purpose of child support

When you make child maintenance payments, you are ensuring that your child’s standard of living is maintained. This means that their health, education and general wellbeing are also sustained.

Child support payments, along with access to children, cause the most conflict between divorcing couples. Try to view your child support payments as benefiting your child, not your ex-partner. The aim is for your child to maintain the same standard of living as when you were together. Why should your child suffer because of the split? Even if your ex-partner is withholding contact, do not withhold payment. If you do, you will be hurting your child twice. Take the moral high ground and know that you can look your child in the eye with a clear conscience.

You can calculate the amount of child maintenance on the official government site.

Thinking about divorce? Read our post on divorcing online.